fayette county lexington ky property tax search

Fayette County collects on average 089 of a propertys assessed fair market value as property tax. Information about zoning plans studies and survey information related to development Development records.

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

Land Contract Land Purchase Contract Contract.

. How to obtain copies. A lien is placed on your title if you have obtained a loan for your vehicle. They are maintained by various government offices in Fayette County Kentucky State and at the Federal level.

Limestone Ste 265 Lexington KY 40507 Tel. Mayor Jim Gray today opened a new payment office to make it more convenient for. They can be reached by.

When the loan has been paid the secured party is required to release the lien. For information on these bills please contact the Fayette County Clerks Office at 859 253-3344. Several government offices in Lexington and Kentucky state maintain Property Records which are a valuable tool for understanding the history of a.

Across the US. Real property tax on median home. Environmental Covenant - Amendment - Termination KRS 22480-190.

If you cannot enclose a tax bill coupon please write the tax bill number account number and property address on your check or money order. Ad Search Local Records For Any City. Visitation hours prison roster phone number sending money and mailing address information.

Ad Uncover Available Property Tax Data By Searching Any Address. Limestone Ste 265 Lexington KY 40507 Tel. Kentucky is ranked 880th of the 3143 counties in the United States in order of the median amount of property taxes collected.

New LexServ office serves citizens. Please call the assessors office in Lexington before you send. The clerks responsibilities include.

Fayette County Jail experiencing staffing shortages. Property Tax Search - Tax Year 2006. View 3439 Rabbits Foot Trail Lexington Kentucky 40503 property records for FREE including property ownership deeds mortgages titles sales history current historic tax assessments legal parcel structure description land use zoning more.

859 253-3344 Land Records Department. Prisons and jails are. Public Property Records provide information on land homes and commercial properties in Lexington including titles property deeds mortgages property tax assessment records and other documents.

Please enter a search term. Limestone Ste 265 Lexington KY 40507 Tel. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Personal checks business checks and counter checks are not accepted. Lexington has launched Phase 1 of our Open Data Initiative. Maintaining list of all tangible personal property.

The Fayette County Detention Center is one of the jails coping with difficulties. Declaration of Trust - Business Trust KRS 386420. Our office accepts cashiers check certified check or money order.

The Property Valuation Administrators office is responsible for. Fayette County Community Corrections was officially opened in 2003 with a capacity to hold about 1017 inmates. Search building and planning records across the city.

Property Tax Search - Tax Year 2021. Our office cannot accept partial payments on delinquent tax bills. The County Clerk serves as the countys official record-keeper.

If the data layer you are seeking is not listed please contact the GIS Office for fee andor licensing information. The Fayette County Clerk is a separate agency from Lexington-Fayette Urban County Government. Current recording effective date is June 10 2022.

The registration of voters and. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. 859-252-1771 Fax 859-259-0973.

Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving customer service efficiency. How do I renew my vehicle registration. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents.

The Fayette County Property Valuation Administrator is responsible for determining the taxable value of your property and any exemptions to which you may be entitled. Visit Our Website Today To Get The Answers You Need. You can find all.

Jun 22 2022 0645 PM EDT. Search for inmates incarcerated in Fayette County Community Corrections Lexington Kentucky. Office of the Fayette County Sheriff.

Deed of Correction KRS 382110. If you have questions regarding your assessment or exemptions please contact. Recording and administration of various official documents.

Sales Tax State Local Sales Tax on Food. Find All The Records You Need In One Place. Deed of Restrictions or Covenants.

Apr 24 2017 1054 am. They are a valuable tool for the real estate industry offering both. Information provided for research purposes only.

Please contact the Appraisal District to verify all. Jun 22 2022 0733 PM EDT. Business licensing and taxes.

Suite 125 Lexington KY 40511. Visit Our Website Today Get Records Fast. The preparation and printing of property tax bills.

You may obtain. We Provide Homeowner Data Including Property Tax Liens Deeds More. VALUES DISPLAYED ARE 2022 PRELIMINARY VALUES AND ARE SUBJECT TO CHANGE PRIOR TO CERTIFICATION.

Condominium Merger or Consolidation KRS 3819163. Property Tax Search - Tax Year 2019. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

If you have documents to send you can fax them to the Fayette County assessors office at 859-246-2729. Make checks payable to Fayette County Clerk. Over 80 GIS layers are available at no cost and are accessible via our Open Data Portal.

Where is the Fayette County Clerks office. You can call the Fayette County Tax Assessors Office for assistance at 859-246-2722. The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200.

Condominium Termination KRS 3819157. 859-252-1771 Fax 859-259-0973. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

The Fayette County Property Valuation located in Lexington Kentucky determines the value of all taxable property in Fayette County KY. Please enclose a check or money order payable to Fayette County Sheriff along with your tax bill coupon. 859-252-1771 Fax 859-259-0973.

Includes information about starting a business occupational license occupational tax and other tax details Development and zoning.

2449 Harden Ln Lexington Ky 40511 Realtor Com

Former Lexington Mayor S Home Value Saw No Change In Years Lexington Herald Leader

308 Thistleton Cir Lexington Ky 40502 Mls 22011870 Redfin

Pin On Southern Antebellum Architecture

With Skyrocketing Home Prices Lexington Owners See Big Property Tax Increases

221 East Seventh Street Lexington Ky For Sale Mls 22001746 Weichert

Lexington Creek Sweep City Of Lexington

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

5421 Jacks Creek Pike Lexington Ky 40515 Realtor Com

216 Castlewood Dr Lexington Ky 40505 Realtor Com

525 Big Bear Ln Lexington Ky 40517 Realtor Com

Property Photos 9124 Harrodsburg Rd Http Www Jessaminepva Com Index Php Page Id 90 Taxroll Page View Record Parcel Property Search Property Home Buying

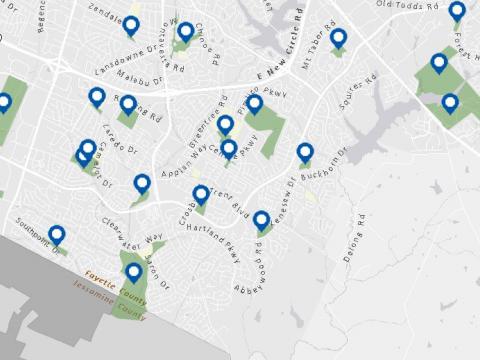

Geographic Information Services City Of Lexington

56 Mentelle Park Lexington Ky 40502 Realtor Com

1723 Banbury Ct Lexington Ky 40505 Realtor Com

547 W Fifth St Lexington Ky 40508 Realtor Com

Property Valuation Notices Mailed Across Fayette County Ky Lexington Herald Leader